《White Paper》Essence Quick View

The number of cars in China has climbed to 350 million by 2024. By the end of 2025, it is expected to exceed 370 million vehicles.

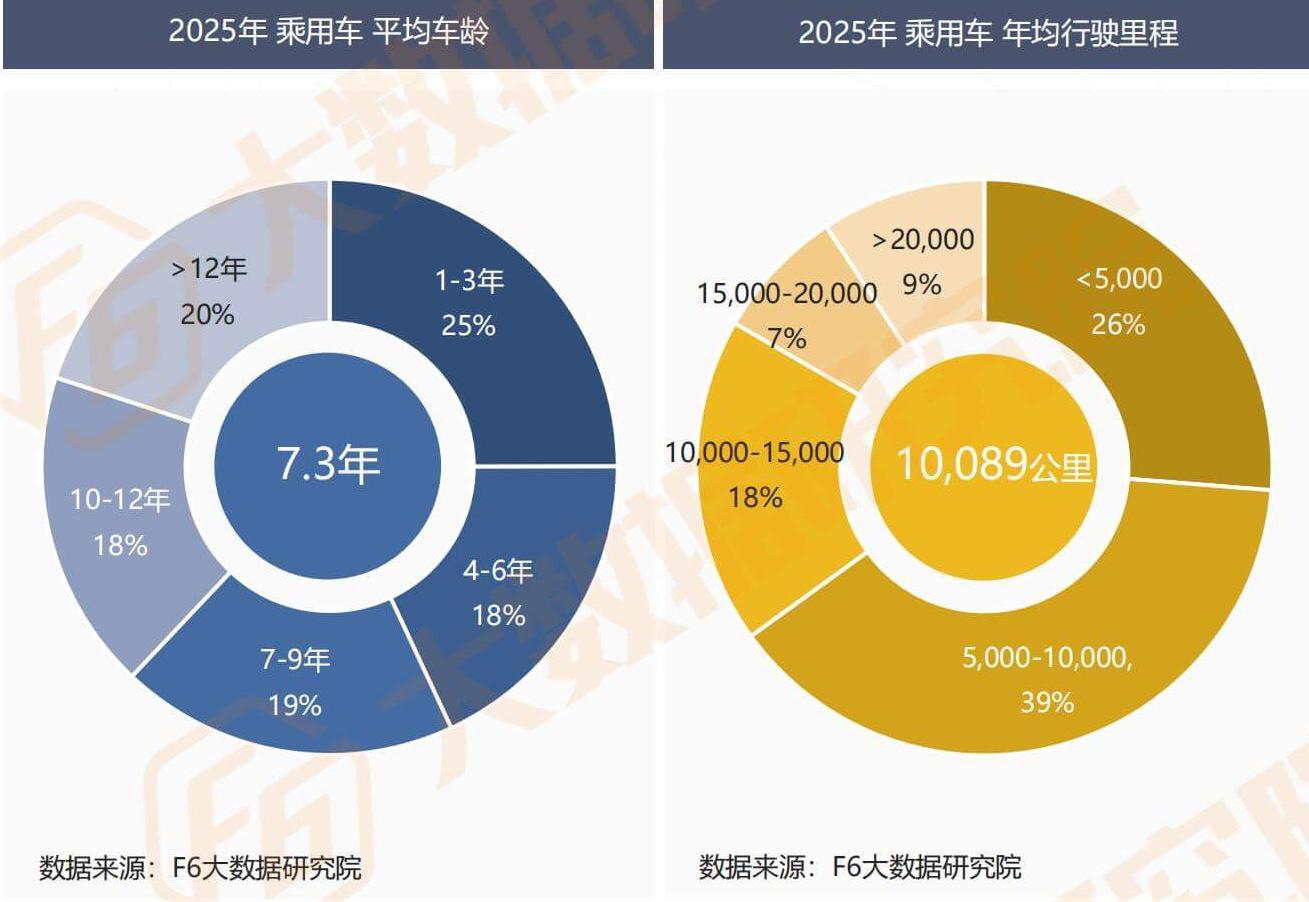

By 2025, the average age of passenger cars in China will be 7.3 years, with an average annual mileage of approximately 10089 kilometers.

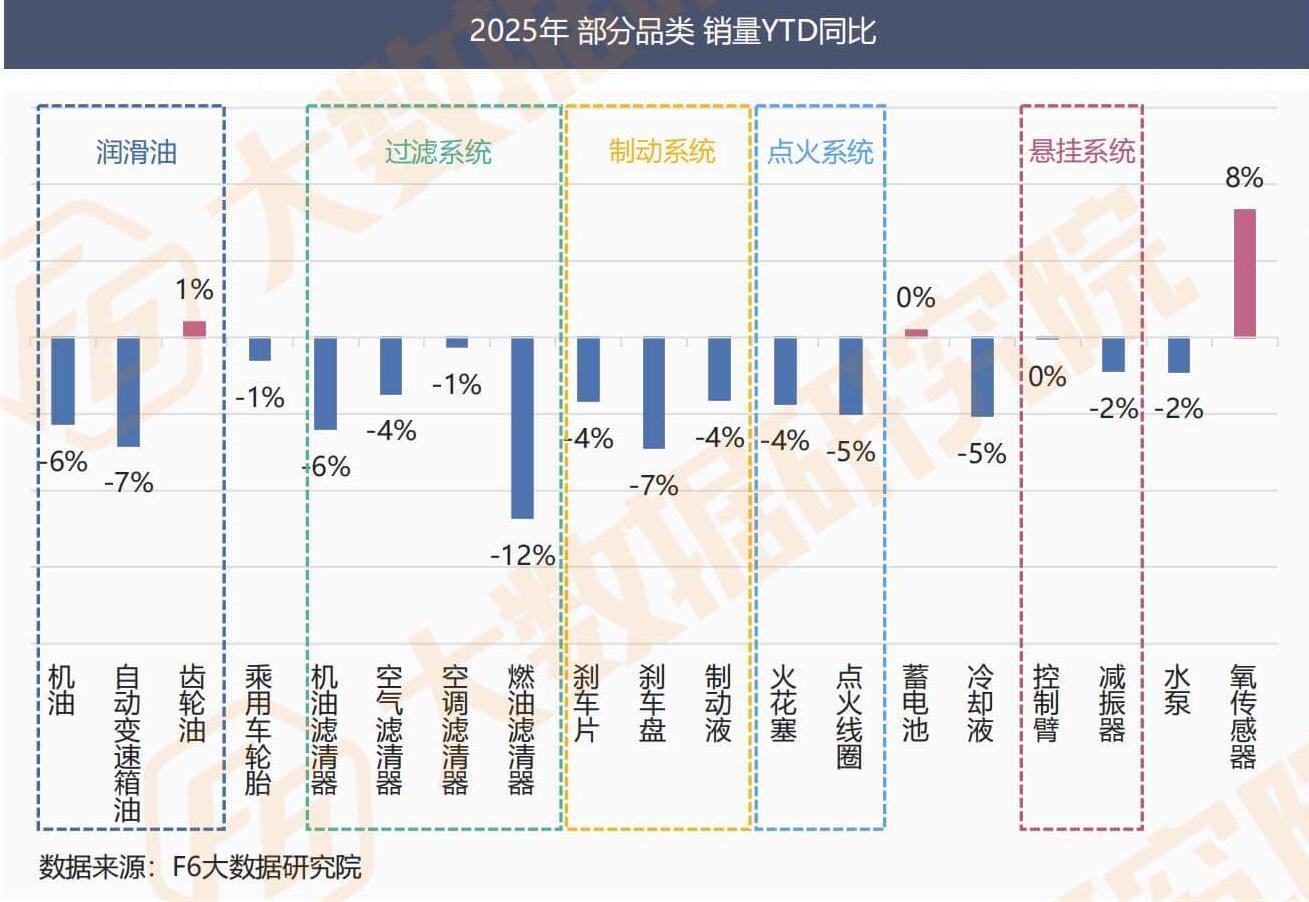

In 2025, the sales of most categories in the aftermarket will decline year-on-year, while the sales of gear oil, batteries, and oxygen sensors will increase year-on-year, and the sales of control arms will remain the same as the same period last year.

In 2025, the competition pattern of major category brands will significantly differentiate, with intensified competition in concentrated categories such as brake fluid and engine oil, and increased concentration in dispersed categories such as gear oil and coolant.

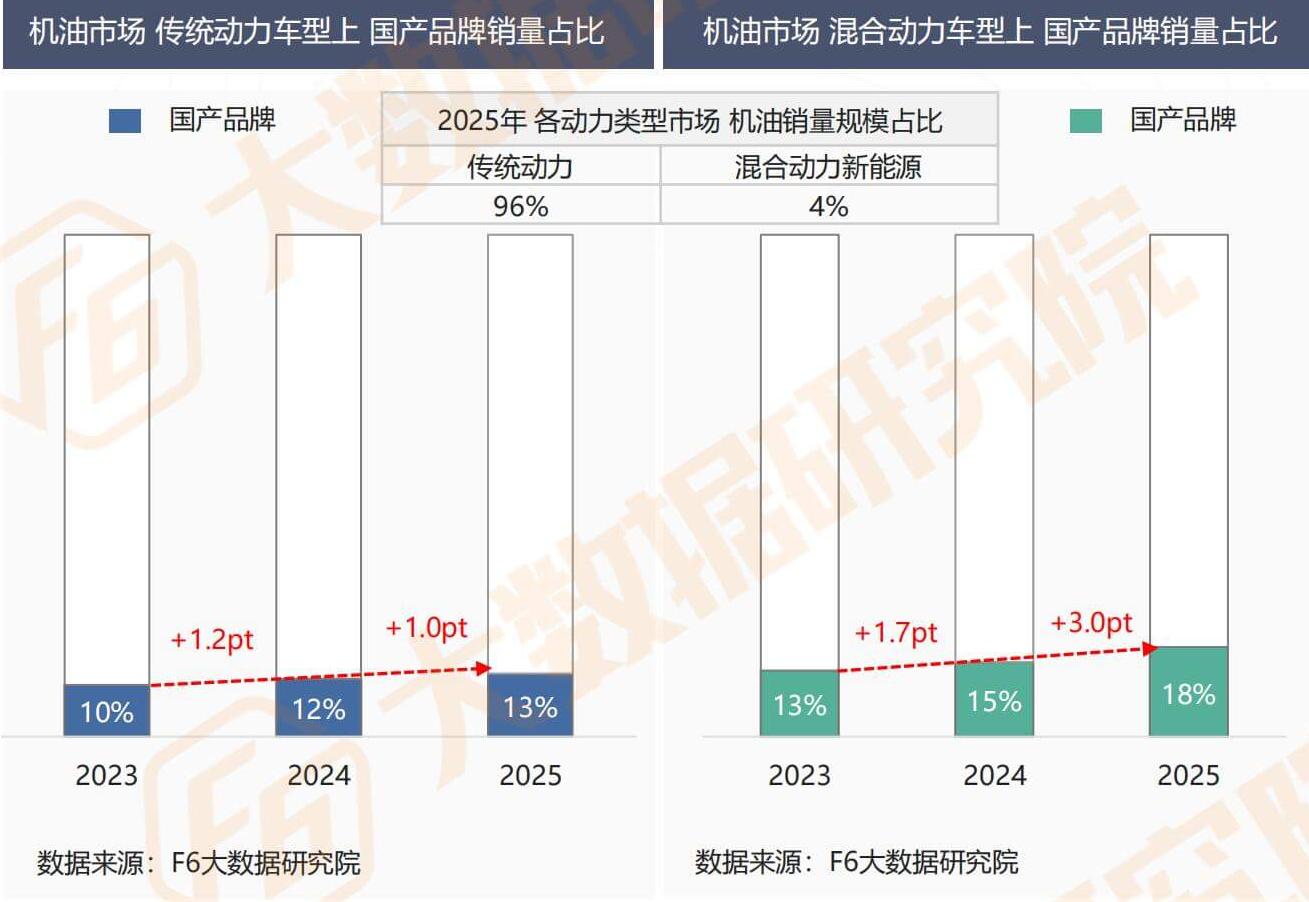

In the oil market, 96% of sales share belongs to traditional fuel vehicles, and domestic brands are increasing their share in both traditional fuel vehicles and hybrid models. Among them, the share and growth rate in the hybrid model market are higher.

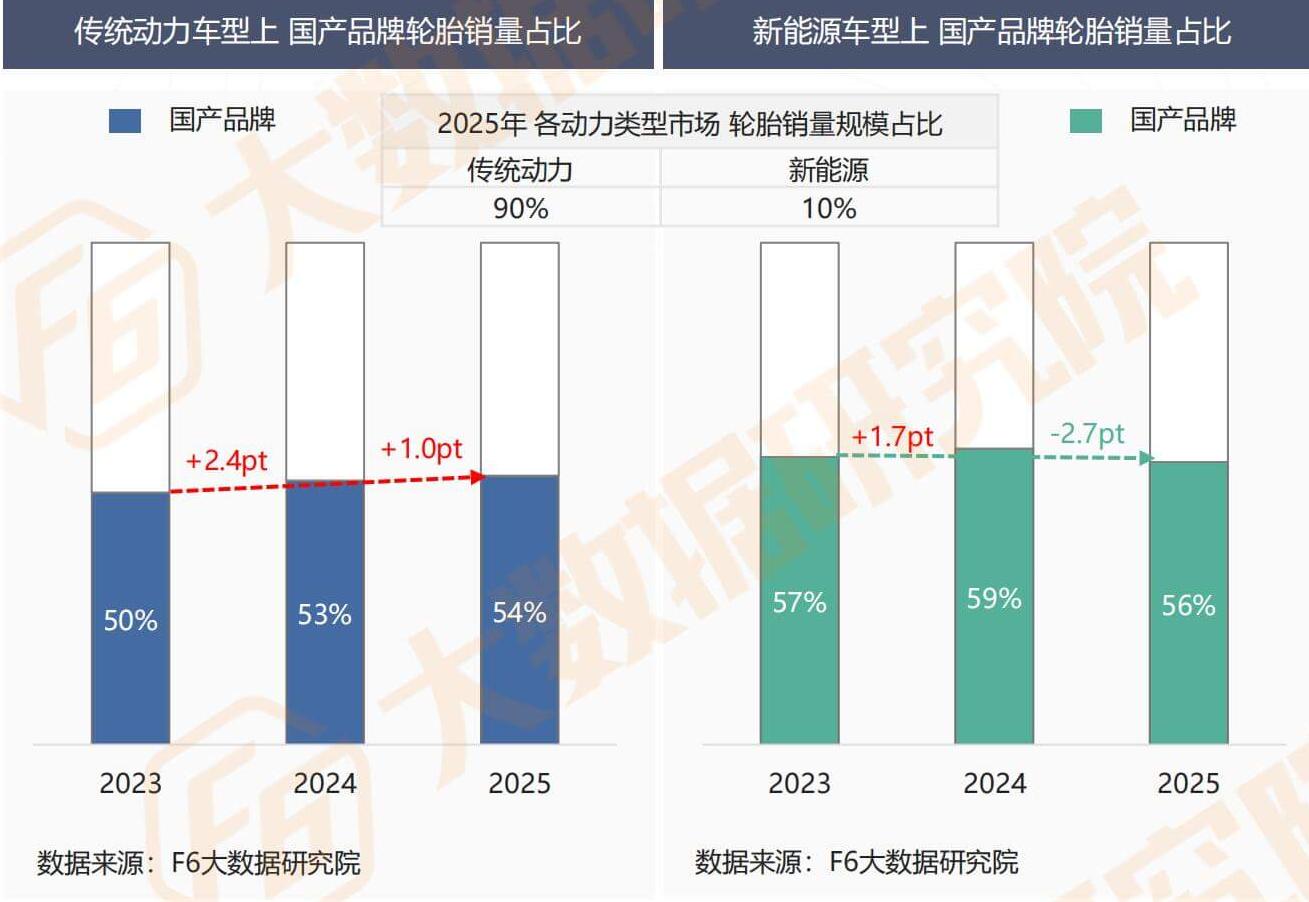

In the passenger car tire market, the competition trend between domestic and foreign brands is intensifying. Traditional oil vehicle field: Domestic brands continue to consolidate their advantages; New energy vehicle track: Foreign brands have stopped falling and rebounded, with a slight reversal trend.

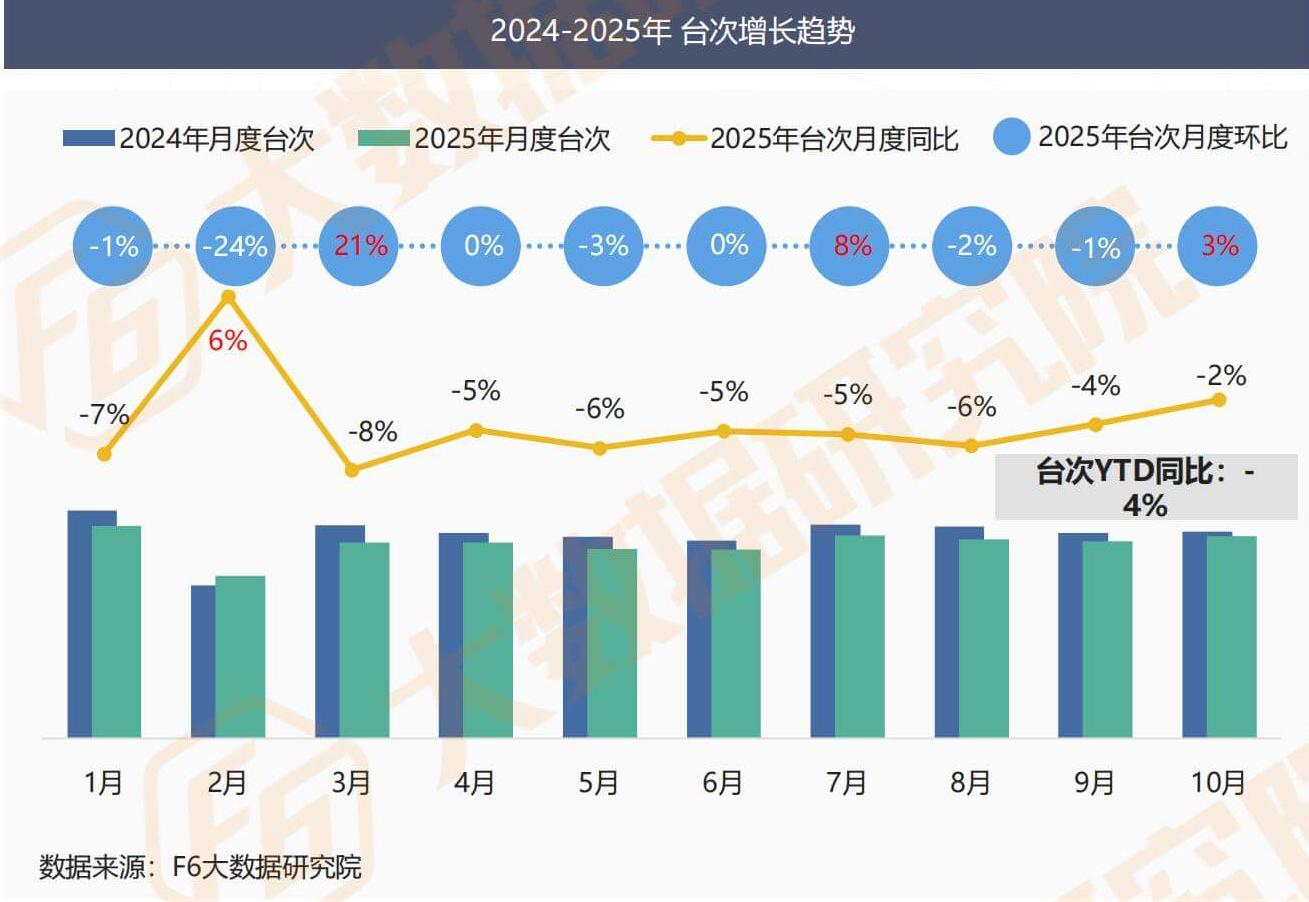

Excluding the Spring Festival factor, all platform numbers in the market will decline year-on-year after 2025, but the current monthly year-on-year decline has significantly narrowed. As of October, the cumulative YTD of platform numbers has decreased by 4% year-on-year.

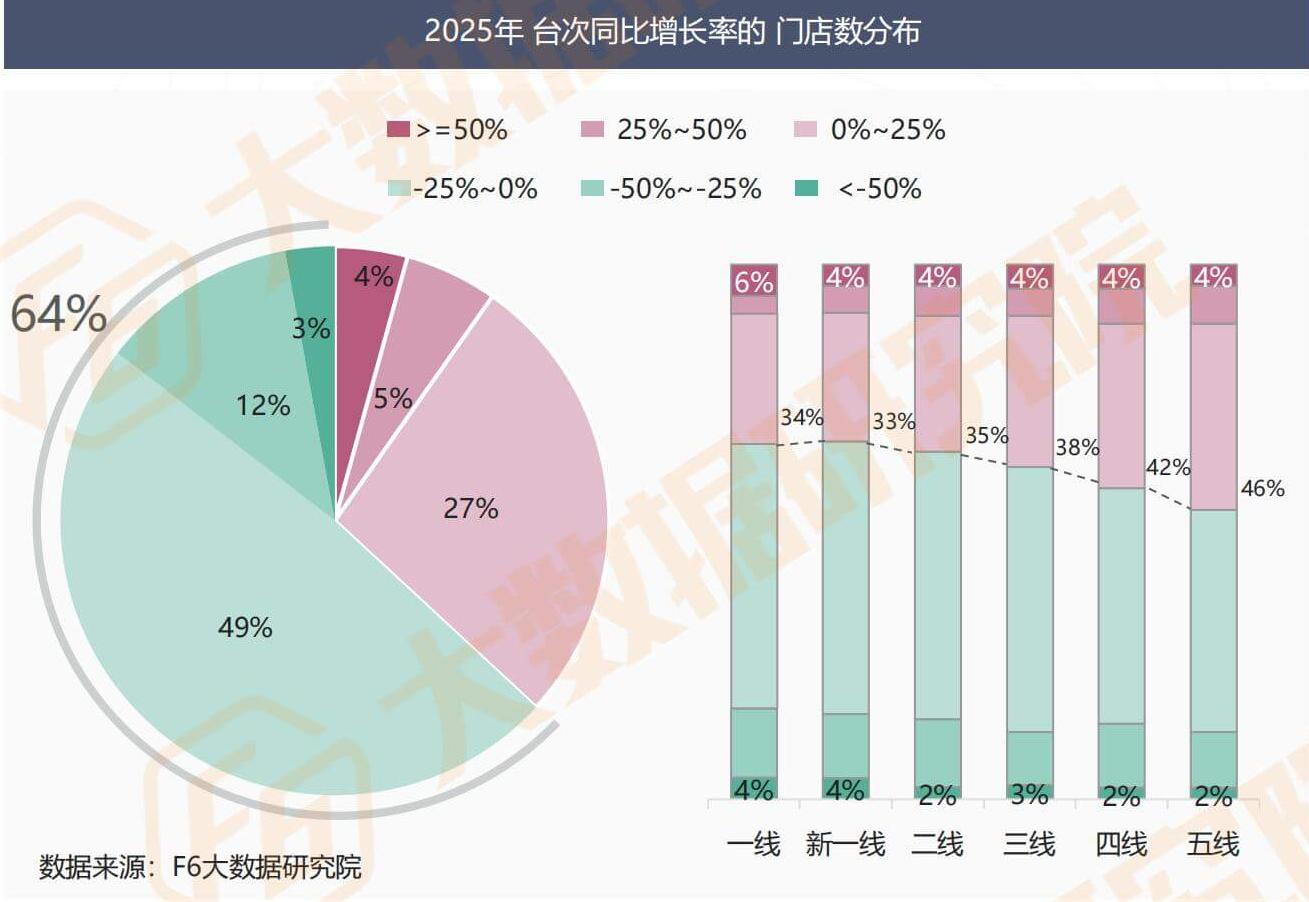

In 2025, 64% of stores will experience a year-on-year decline in their inbound orders, while 15% of stores will see a year-on-year decrease of over 25% in inbound orders. The proportion of stores in lower tier markets experiencing a year-on-year increase in inbound orders will be even higher.

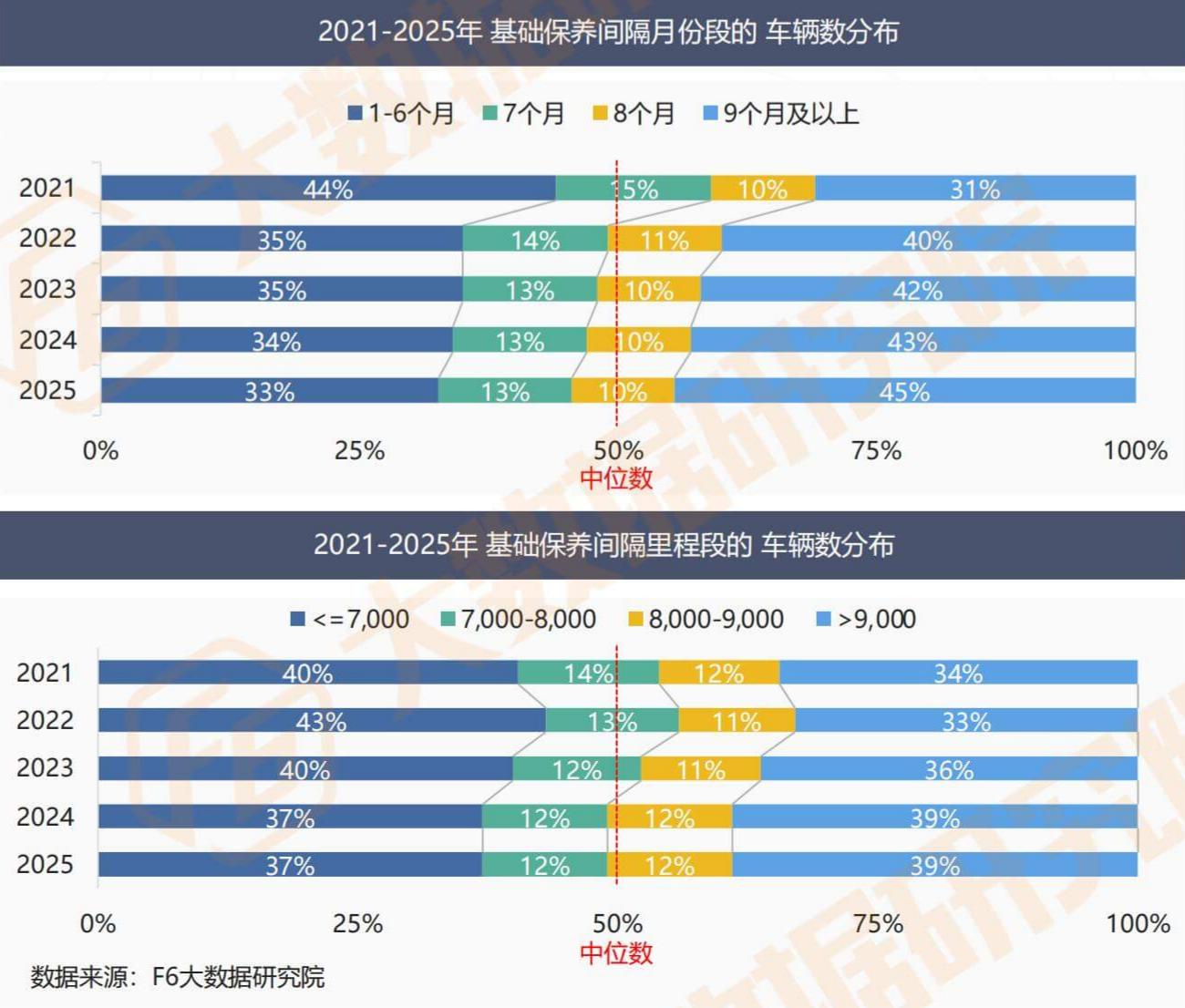

The basic maintenance shows the characteristic of "double backward shift in duration and mileage", which leads to a decrease in the frequency of vehicle maintenance, reflecting that the owner's planning for vehicle maintenance is more rational (economical).

The proportion of streamlined business needs entering the factory continues to increase (only one service item is consumed upon entering the factory), reflecting the precision (cost saving) tendency of car owners' consumption needs.

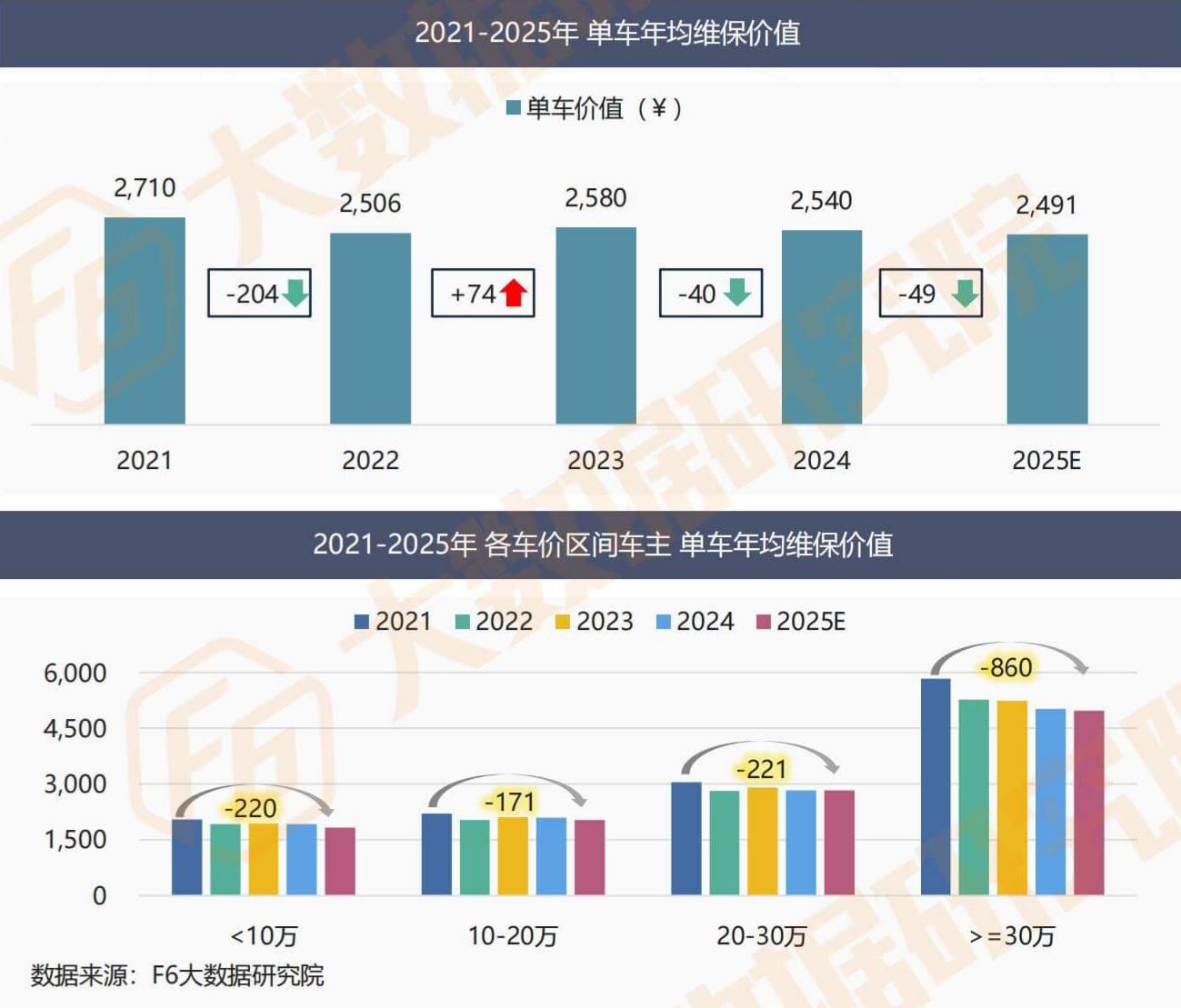

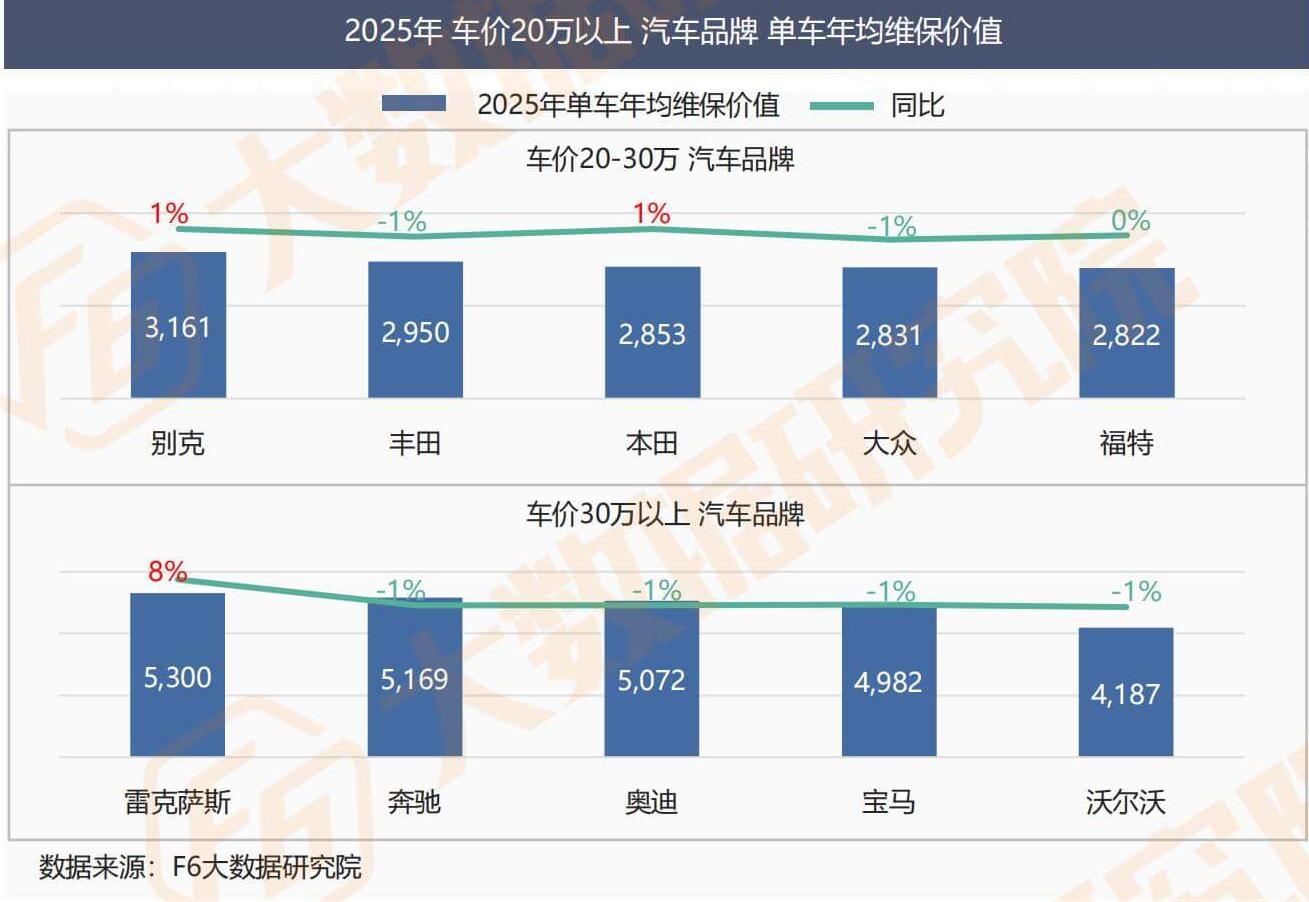

In the past two years, the average annual maintenance value of bicycles has shown a slight decline, and reducing the cost of using cars has become a common trend among all car owners. The annual maintenance value of high priced car models above 300000 yuan is still the highest.

Among the brands of car models with a price of over 200000 yuan, the average annual maintenance value of each brand's owner's bicycle increases proportionally with the car price, and there is a significant difference in maintenance value among different brand owners within the same price range.

The number of new energy vehicles entering the independent after-sales channel continues to grow rapidly, exceeding 10% in the third quarter of 2025 and accounting for 8.9% of the total for the year. The proportion structure of the three different types of power entering the factory tends to stabilize.

1、Motor vehicle ownership

The number of automobiles in China has climbed to 350 million by 2024, and is expected to exceed 370 million by the end of 2025, with passenger cars expected to reach 320 million.

As of the end of 2024, the number of automobiles in China has reached 350 million, including 310 million passenger cars, a year-on-year increase of 6%. Since 2016, the growth rate of passenger car ownership has gradually slowed down, but the growth trend remains unchanged. It is expected that the car ownership will exceed 370 million by 2025, and the passenger car ownership will reach 320 million.

The growth of car ownership is driven by multiple factors such as policy support, economic development, urbanization process, and technological progress. Overall, the sustained growth of the Chinese automotive market not only reflects the improvement of residents' consumption ability and economic development, but also provides a new growth engine for the global automotive industry, leading the industry transformation in the directions of electrification, intelligence, and greening. Compared to major countries around the world, although China has the highest number of cars in the world, the average number of cars per thousand people is only about 250, far lower than the United States' about 868, Japan's 624, and Germany's 590, indicating that there is still room for growth in the Chinese market.

2、Average age of passenger cars

By 2025, the average age of passenger cars in China will be 7.3 years, with an average annual mileage of approximately 10089 kilometers.

(The following two indicators show an increasing and decreasing trend respectively)

The average age of passenger cars in China is 7.3 years by 2025, and has shown an increasing trend in recent years. The improvement of circulation efficiency in the second-hand car market has extended the lifecycle of vehicles. At the same time, the range and quality improvement of some new energy vehicles have improved users' willingness to hold them, thereby changing the pace of vehicle age updates. It is worth noting that new energy vehicles continue to enter the market, and some old fuel vehicles are gradually being phased out, but the pace of elimination is still slower than the speed of new car launches. The overall growth rate of vehicle age may slow down in the future, fluctuating around 7-8 years.

The average annual mileage of passenger cars in China in 2025 is about 10089 kilometers, a decrease of 3% compared to 2024. The main reason is the diversification of transportation modes for urban residents: on the one hand, some middle and high-income families own multiple cars, resulting in a decrease in the frequency of bicycle usage; On the other hand, shared mobility, public transportation, and urban congestion policies have dispersed the efficiency of personal passenger car travel.

In the future, with the rapid popularization of new energy vehicles and policy optimization, the Chinese passenger car market will exhibit new characteristics of significant structural differentiation. The age and mileage differences of different categories of vehicles, such as fuel vehicles/new energy vehicles, traditional sedans/SUVs, will become more pronounced.

Note: For the average age of subdivided power types, please refer to Chapter 5 "Electric Age" of this white paper; The mileage will be analyzed in detail in Chapter 4, 'Owner Insights'

3、Year-on-year sales

In 2025, the sales of most categories in the aftermarket will decline year-on-year, while the sales of gear oil, batteries, and oxygen sensors will increase year-on-year, and the sales of control arms will remain the same as the same period last year.

As of October 2025, the sales performance of various sub categories in the automotive aftermarket has shown a clear trend of differentiation. Specifically, the sales of gear oil increased slightly by 1% year-on-year, which is partly due to the continuous rise in sales of new energy vehicle models. Gear oil still has certain application demands in electric vehicles and hybrid systems. The sales of oxygen sensors achieved a year-on-year growth of 8%, with relatively outstanding performance. On the one hand, with the extension of the service life and the increase of accumulated mileage of some old vehicles, the demand for replacing oxygen sensors among car owners has increased; On the other hand, the comprehensive implementation of China VI emission standards has put forward higher requirements for exhaust emission control, and vehicles need to rely on the precise cooperation of oxygen sensors to ensure the compliance of emission indicators.

In sharp contrast to the above categories, other key categories such as lubricants, passenger car tires, filtration systems, braking systems, ignition systems, etc. are experiencing varying degrees of sales decline pressure. This change may be closely related to factors such as the overall adjustment of car usage frequency, changes in car owners' maintenance habits, and the continuous increase in the proportion of new energy vehicles. At the same time, it also reflects the increasing differentiation of growth and decline trends in various sub categories of the automotive aftermarket, and the increasingly complex market competition pattern. In this context, enterprises need to be more targeted in inventory management, product layout, and marketing strategies to effectively respond to fluctuations in demand for different product categories.

Note: Data as of October 2025; Gear oil includes oil for manual transmission, front and rear differentials, and EV gearbox position replacement

4、Brand competition pattern

In 2025, the competition pattern of major category brands will significantly differentiate, with intensified competition in concentrated categories such as brake fluid and engine oil, and increased concentration in dispersed categories such as gear oil and coolant.

In 2025, the competition pattern of various categories of brands in the automotive aftermarket will show significant differentiation, and categories with different concentrations will evolve along a differentiation path, specifically manifested as:

Brand concentration categories: Represented by brake fluid and engine oil, the number of brands within the top 80% share in 2025 is less than 15, but it has increased compared to 2024. The addition of new brands has further intensified the market competition that was originally dominated by the top players, and the competition dimensions have become more diverse.

Brand dispersed categories: presenting a dual track feature of "integration" and "more dispersion". The number of brands within the top 80% share of categories such as gear oil and coolant in 2025 will decrease compared to 2024, and small and medium-sized brands will gradually be integrated, resulting in an increase in category concentration. The opposite trend is observed in categories such as air conditioning filters and passenger car tires, with an increase in the number of brands within the top 80% share in 2025 compared to 2024, further reducing the concentration of categories among new entrants.

Overall, this differentiation trend is the result of the combined effect of market demand upgrading and industry competition deepening, and also indicates that various categories in the automotive aftermarket will gradually move towards a mature development stage of "concentrated category cultivation barriers and dispersed category differentiation evolution".

Note: Continuously observe the changes in the number of brands within the top 80% market share of each category from 2024 to 2025

5、Oil market

In the oil market, 96% of sales share belongs to traditional fuel vehicles, and domestic brands are increasing their share in both traditional fuel vehicles and hybrid models. Among them, the market share and growth rate of hybrid vehicles are higher.

In the oil market by 2025, traditional power vehicles will dominate with a sales volume of 96%.

Domestic brand engine oil has achieved positive growth in different power type markets, as shown by:

Traditional power vehicle market: The proportion of domestic brand sales has steadily increased from 10% in 2023 to 13% in 2025, with a cumulative growth of 2.2 percentage points over the past three years and a steady growth pace.

Hybrid new energy vehicle market: The proportion of domestic brand sales has grown rapidly, from 13% in 2023 to 18% in 2025, with a cumulative growth of 4.7 percentage points over the past three years.

It is worth noting that although the overall size of the hybrid vehicle oil market is relatively small (only 4%), the increase in the proportion of domestic brands in this field is significantly higher than that of the traditional power vehicle market. This difference not only reflects the first mover competitive advantage of domestic engine oil brands in the new energy related field, but also indicates that they have stronger market growth potential and strategic layout value in the future trend of power type switching.

Note: Hybrid new energy includes extended range electric and plug-in hybrid models

6、Passenger car tire market

In the passenger car tire market, the competition trend between domestic and foreign brands is intensifying. Traditional oil vehicle field: Domestic brands continue to consolidate their advantages; New energy vehicle track: Foreign brands have stopped falling and rebounded, with a slight reversal trend.

In the passenger car tire market by 2025, traditional power models will occupy an absolute dominant position with a sales volume of 90%.

From the perspective of brand competition, domestic and foreign brands exhibit differentiated trends in different types of power tracks, specifically manifested as:

Traditional power vehicle market: The advantage of domestic brands continues to deepen, and the sales proportion steadily increases from 50% in 2023 to 54% in 2025, with a cumulative growth of 4 percentage points in three years.

New energy vehicle market: Foreign brands are showing a reversal trend of "decline and rebound". The proportion of domestic brands will increase from 57% to 59% in 2023-2024, while the share of foreign brands is under pressure to decline; But by 2025, foreign brands will rebound, and the proportion of domestic brands will fall back to 56%.

It is worth noting that although the overall market share of new energy vehicle models is still at a relatively low level (10%), the "foreign capital reversal" trend presented in this niche track still has crucial significance that cannot be ignored. This trend clearly demonstrates the latecomer adjustment and rapid adaptation capabilities of foreign brands in the core technology research and development of new energy special tires, as well as the integration of strategic cooperation resources with automotive companies. Looking ahead to the future, with the continuous increase in the penetration rate of new energy vehicles, the market size of new energy specialized tires will gradually expand, and the dynamic changes in the brand competition pattern of this track will also become an important variable affecting the overall development trend of the passenger car tire market.

7、Monthly sales in the aftermarket

Excluding the Spring Festival factor, all platforms in the market will experience a year-on-year decline after 2025. However, the current monthly year-on-year decline has significantly narrowed, with a cumulative YTD decline of 4% as of October.

From the perspective of year-on-year growth, after excluding seasonal interference caused by the Spring Festival holiday, the monthly performance of incoming units in the automotive aftermarket in 2025 did not reach the same level as the same period in 2024. This phenomenon fully reflects the sustained contraction pressure faced by demand correction. As of the end of October, the cumulative number of incoming units for the whole year has decreased by 4% year-on-year, and the industry demand side is still under heavy downward pressure.

However, looking at the overall operating trend, the market maintenance demand has shown a positive trend of phased recovery: after March, the year-on-year decline in the number of factory entries in the market hit a temporary trough of 8%, and the year-on-year decline in subsequent months has narrowed, indicating a continued trend of recovery. Especially in October, the year-on-year decline in the number of incoming units has further narrowed to 2%. This data change indicates that although the current market demand is still in a contraction state, the magnitude of the contraction has significantly converged. For the automotive aftermarket, this gradually improving trend may be a positive signal that industry demand is stabilizing and there is hope for a gradual recovery in the future.

Note: The number of entry into the factory does not include car washing; Data as of October 2025

8、Store entry number

In 2025, 64% of stores will experience a year-on-year decline in their inbound orders, while 15% of stores will see a year-on-year decrease of over 25% in inbound orders. The proportion of stores in lower tier markets experiencing a year-on-year increase in inbound orders will be even higher.

The distribution of the year-on-year growth rate of store numbers in 2025 and the segmented data at different city levels comprehensively reflect that the growth of store numbers is characterized by a medium to low range, and the impact of city level on the growth structure shows significant regularity. Specifically manifested as:

In 2025, the overall pattern of store growth will be dominated by low growth and scarce high growth: over 60% of stores are facing negative growth pressure, and only 9% of stores have achieved a high growth level of over 25% year-on-year, highlighting the scarcity of high growth stores.

Horizontally observing from the city level dimension, the growth characteristics of markets at different levels show significant differences: the lower the city level, the higher the proportion of stores with year-on-year growth in platform numbers, among which the proportion of stores with year-on-year growth in platform numbers in fourth and fifth tier cities exceeds 40%.

The formation of this differentiation phenomenon is mainly influenced by three factors:

Residents in developed cities are more sensitive to economic cycles, and the behavior of car maintenance is gradually shifting from traditional "on-time maintenance" to "on-demand maintenance", which directly leads to a weakening of the growth momentum of vehicle numbers;

The penetration rate of new energy vehicles is relatively higher in developed cities, but their maintenance frequency and number of maintenance items are lower than traditional fuel vehicles, which further suppresses the growth of stores in developed cities;

The competition in the automotive aftermarket of developed cities is more intense, and the accelerated expansion of chain brand stores has intensified customer diversion, putting significant pressure on the growth of traditional individual stores.

Note: Data as of October 2025

9、Basic maintenance

The basic maintenance shows the characteristic of "double backward shift in duration and mileage", which leads to a decrease in the frequency of vehicle maintenance, reflecting that the owner's planning for vehicle maintenance is more rational (economical).

In 2025, the interval between basic maintenance for car owners will continue to shift backward: the proportion of car owners who only enter the factory for maintenance after an interval of 9 months or more will reach 45%, an increase of 2 percentage points from 2024; The median interval between months is currently stable at around 8 months, but still showing a backward trend.

From the perspective of maintenance interval mileage, the changes are also prominent: before 2023, the median basic maintenance interval mileage of car owners was concentrated at 7000-8000 kilometers, while in the past two years, this median has shifted to 8000-9000 kilometers, and the interval mileage has significantly increased.

The continuous extension of the time and mileage interval for basic maintenance of car owners will directly lead to a decrease in the frequency of entering the store. This change not only reduces the contact opportunities between maintenance stores and car owners, but also indirectly weakens the conversion potential of derivative maintenance businesses such as tire replacement, chassis maintenance, and oil upgrades, becoming one of the key factors causing the decline in various business units and pressure on sales of multiple categories in the automotive aftermarket.

10、Simplify the entry times for business requirements

The proportion of inbound transactions that streamline business needs continues to increase, with only one service item consumed upon arrival, reflecting a tendency towards precision (cost saving) in car owners' consumption needs.

In 2025, the consumption behavior of car owners in the process of vehicle maintenance will show a more obvious "simplified" feature: the proportion of car owners who consume 4 or more items in a single factory visit will further decrease to 8%. This data not only sets a new low, but also continues the continuous downward trend in the past three years, reflecting that the multi item package consumption model is gradually being abandoned by car owners.

Behind this distinct change in behavior is a profound shift in car owners' consumption concepts: nowadays, the demand for car owners to enter the factory for maintenance is becoming simpler, and the purpose of each consumption is becoming increasingly clear - mostly to solve specific vehicle problems or complete necessary maintenance, rather than passively accepting additional services. This also means that the traditional model of relying on "bundled marketing" and "project stacking" to drive consumption in the past is no longer in line with the decision-making logic of local car owners, which puts higher demands on the refined operation of maintenance service providers.

11、Annual average maintenance value of bicycles

In the past two years, the average annual maintenance value of bicycles has shown a slight decline, and reducing the cost of using cars has become a common trend among all car owners. The annual maintenance value of high priced car models above 300000 yuan is still the highest.

In 2025, the average annual maintenance value of car owners' bicycles continues the slight downward trend of 2024 and has fallen below 2500 yuan.

From the perspective of segmented car prices, for car owners of models priced below 300000 yuan, although the average annual maintenance value of their bicycles has not yet recovered to the level of 2021, it has maintained a slight downward trend overall; For high-end car owners with a price of over 300000 yuan, the average annual maintenance value of a single vehicle has significantly decreased, especially compared to 2021, with an average annual shrinkage of nearly a thousand yuan. The core reason for this difference is that the cost compression space for car owners of models priced below 300000 yuan is relatively limited, while high-end car owners have a wider range of accessory choices and still have room for further cost reduction。

12、Annual maintenance value of car models over 200000 yuan

Among the brands of car models with a price of over 200000 yuan, the average annual maintenance value of each brand's owner's bicycle increases proportionally with the car price, and there is a significant difference in maintenance value among different brand owners within the same price range.

Focusing on car models priced over 200000 yuan, there are significant differences in the average annual maintenance value of bicycles among owners of different car brands.

In the price range of 200000 to 300000 yuan, the average annual maintenance value of Buick owners' bicycles exceeds 3000 yuan, while the average annual maintenance value of Toyota, Honda, Volkswagen, and Ford owners fluctuates in the range of 2800-3000 yuan, and remains stable compared to 2024;

In the price range of over 300000 yuan, the average annual maintenance value of Lexus, Mercedes Benz, and Audi's bicycles exceeds 5000 yuan, which is at a high level. Among them, Lexus owners' bicycle maintenance value in 2025 shows a significant upward trend, becoming a prominent highlight in this range. From the observation of specific consumption behavior data of car owners, it is found that compared to 2024, the after-sales service structure of Lexus car owners has undergone significant changes in 2025, with the proportion of maintenance business demand increasing by nearly 5 percentage points, becoming the core factor driving the growth of Lexus car owners' bicycle maintenance value.

Note: The above is the average annual maintenance value of traditional fuel vehicle brands within the same price range

13、Independent after-sales channel

The number of new energy vehicles entering the factory through independent after-sales channels continues to grow rapidly. In the third quarter of 2025, it has exceeded 10%, accounting for 8.9% of the total year, while the proportion structure of the three different types of power entering the factory tends to stabilize.

In 2025, the proportion of new energy vehicles entering the independent after-sales system of Chinese automobiles will increase by 1.7 percentage points compared to 2024, continuing the steady upward trend of the past four years. From the quarterly operating data, the proportion of new energy vehicle arrivals in the second and third quarters of 2025 has been fluctuating around 10%, maintaining a relatively high level, which intuitively reflects the increasing demand for maintenance and services from new energy vehicle owners. At a deeper level, the rapid increase in the number of new energy vehicles is the core driving factor that drives the synchronous growth of market activity in maintenance and service for new energy vehicle owners.

From the perspective of power structure, the proportion of new energy vehicle models entering the factory is gradually stabilizing: pure electric vehicle models still firmly occupy the mainstream position in the after-sales market of new energy vehicles, and their market share remains relatively stable; At the same time, the maintenance demand for extended range electric vehicles is showing a significant upward trend, which indirectly reflects the rapid increase in acceptance of this type of vehicle among the user group; In recent years, the proportion of plug-in hybrid models entering the factory has decreased, reflecting a slight adjustment in the focus of the new energy after-sales market.

Note: Data as of October 2025; The number of entry into the factory does not include car washing

Follow WeChat mini program to learn more about market trends