Summary of Research Results

1、Changes in output value per unit

In 2025, the automotive aftermarket will show a dual index downward trend, with cumulative output and units both declining by 5% year-on-year, including a 5% year-on-year decline in output and units in the fourth quarter.

In 2025, the segmented track differentiation pattern of the automotive aftermarket will become prominent, and fast repair and maintenance stores will be the "main force" in the market to resist the decline, with a year-on-year decline of 3%. Tire stores and 4S stores will be the hardest hit areas of the decline (-8%).

In 2025, the year-on-year decline in output value of the three major essential businesses of tires, maintenance, and repair will all be within 5%, highlighting their resilience against risks, while sheet metal spraying and other businesses will face greater pressure to contract output value.

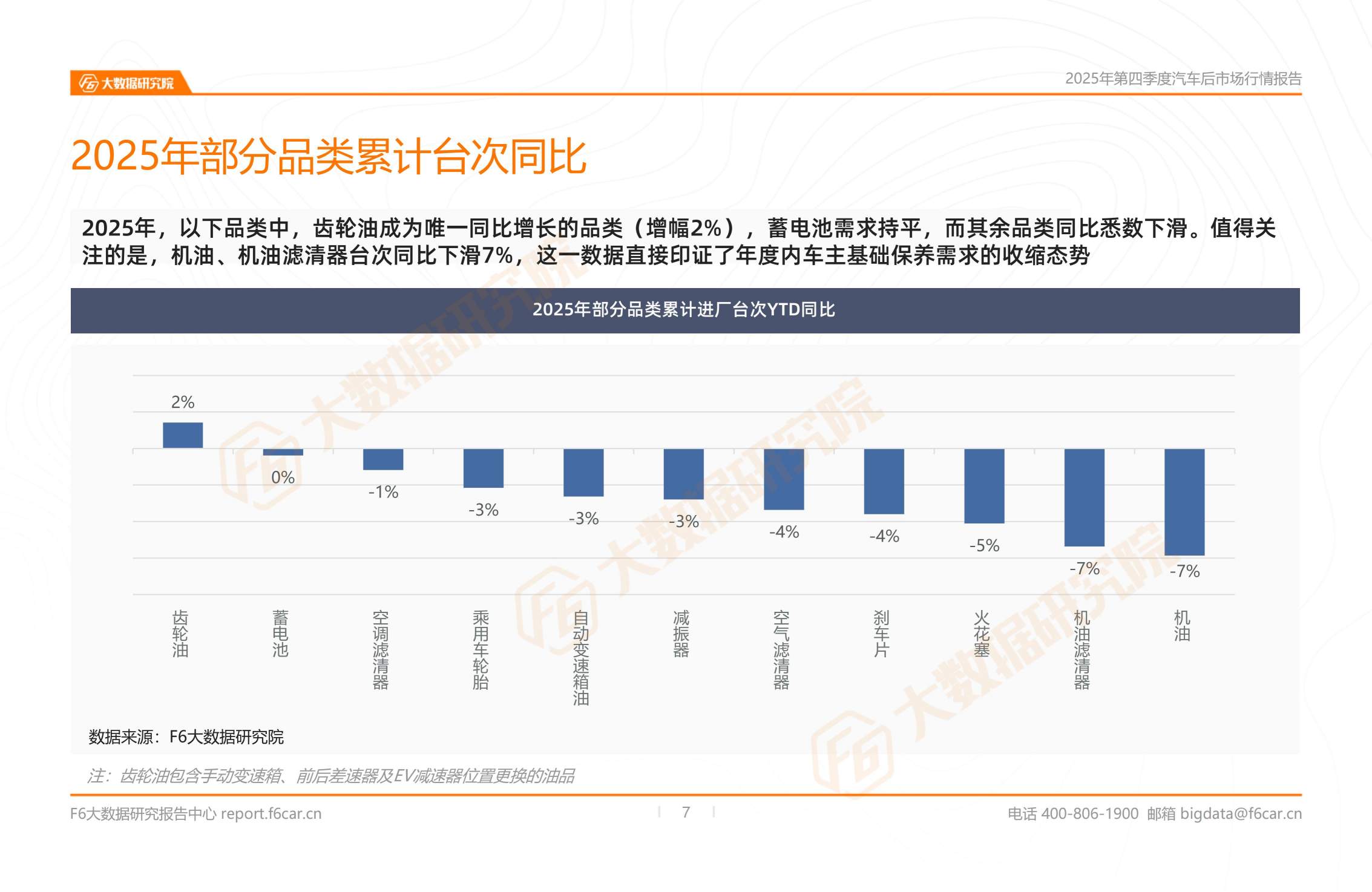

2、Category sales

In 2025, the cumulative number of imported gear oil units will increase by 2% year-on-year, but sales will only remain the same as last year; The cumulative number of automatic transmission oil entering the factory decreased by 3% year-on-year, but the sales volume decreased by 7% year-on-year.

In the fourth quarter, multiple categories such as engine oil and spark plugs are facing a global decline. The growth opportunities for shock absorbers are mainly focused on the northwest, central, and eastern regions, while the opportunities for batteries are mainly concentrated in the northeast region.

In the fourth quarter, seven categories including brake pads and engine oil struggled to break through the growth bottleneck in various tier cities, exposing the general weakness of their consumption momentum, while passenger car tires found a breakthrough in third - and fourth tier cities (with a growth rate of 2% -4%).

3、Car brand

In 2025, among the major automobile brands, BYD's year-on-year growth rate in the number of vehicles entering the factory is leading, reaching 10%, while Chevrolet, Kia, and Hyundai's three major brands' year-on-year decline in the number of vehicles entering the factory is as high as 13%, forming a sharp contrast.

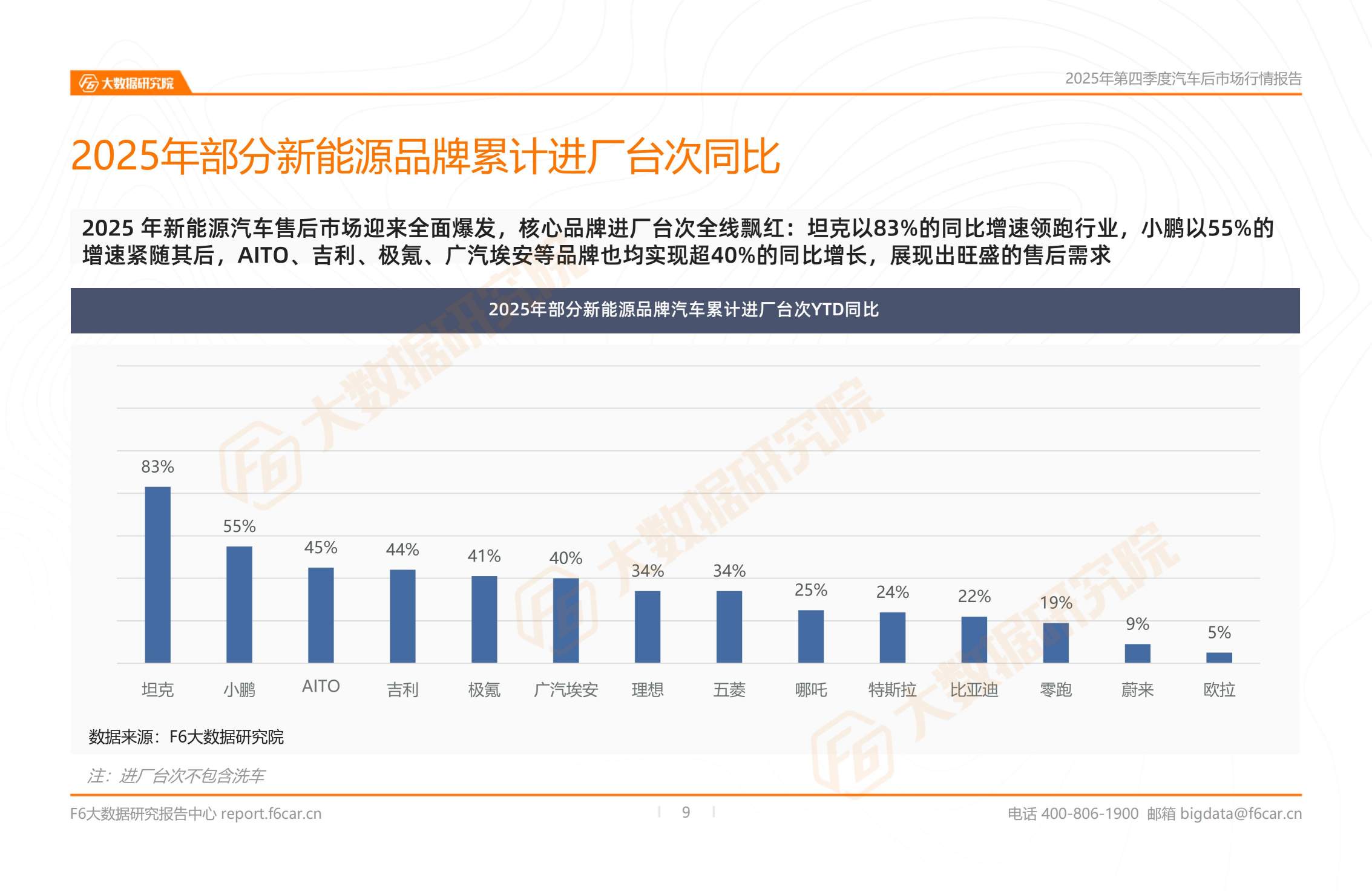

In 2025, the after-sales market for new energy vehicles will experience a comprehensive outbreak, with the number of core brands entering the factory soaring, demonstrating strong after-sales demand.

In 2025, the output value and number of traditional automobiles will both decline by 7% year-on-year, while new energy vehicles of various power types will still maintain strong growth momentum.

4、Industry trends

In the fourth quarter of 2025, the sales volume of passenger cars cooled down, but it still increased by 4% year-on-year for the whole year.

In the fourth quarter of 2025, the proportion of new energy vehicles entering the factory continued to grow, approaching 11%.

Throughout the year, the year-on-year trend of cumulative output value in the aftermarket has not yet reached a turning point of recovery, and the overall market has shown the operating characteristics of "hovering at a low level and weak boost"

Interpretation of essence

1、Cumulative output value/number of units in 2025 compared to the same period last year

Looking at the development trend throughout 2025, the automotive aftermarket presents a dual index downward trend, with a year-on-year decrease of 5% in cumulative output value and number of imported units.

2、Cumulative number of stores of different types compared to the same period last year

The differentiation pattern of the automotive aftermarket segmentation track in 2025 is highlighted:

1. Quick repair and maintenance stores are the "main force" in the market, highlighting the stability advantage of essential services with a year-on-year decrease of 3%;

2. Non fast repair and maintenance stores are generally facing significant downward pressure, with declines exceeding 5%, with tire stores and 4S stores being the hardest hit areas.

3、Fourth quarter output value of different types of services on a month on month basis

In the fourth quarter of 2025, the output value of various businesses in the aftermarket was under pressure to decline year-on-year, with the tire business showing the strongest resistance with a 2% year-on-year decline. Extending to the full year cycle, the year-on-year decline in output value of the three major essential businesses of tires, maintenance, and repair is within 5%, highlighting their resilience against risks, while sheet metal spraying and other businesses face greater pressure to contract output value.

4、Cumulative number of units in some categories compared to the same period last year

In 2025, among the following categories, gear oil will become the only category with a year-on-year growth rate of 2%, while battery demand will remain stable, while all other categories will decline year-on-year. It is worth noting that the number of engine oil and oil filters decreased by 7% year-on-year, which directly confirms the shrinking trend of basic maintenance needs of car owners during the year.

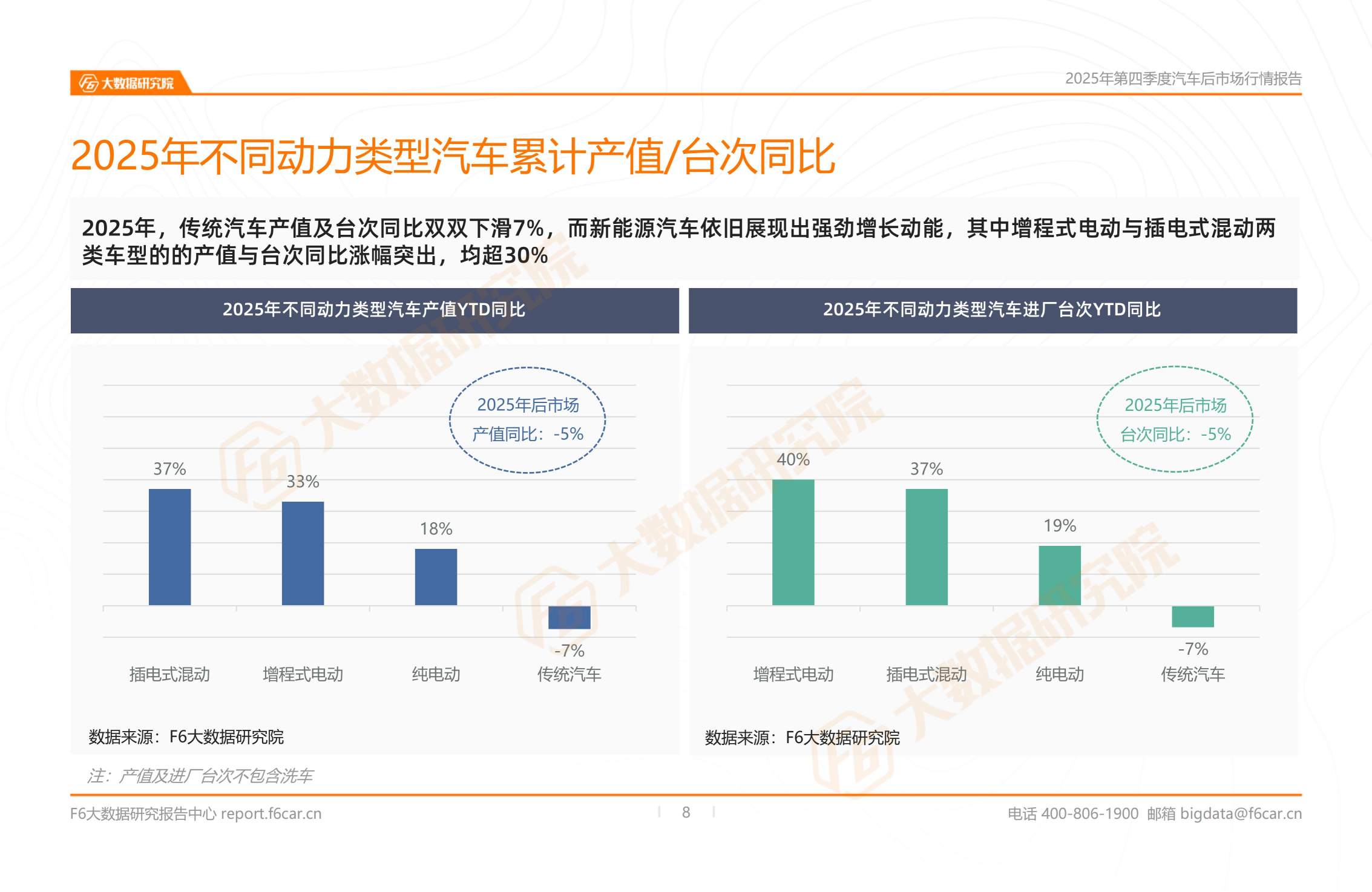

5、Cumulative output value/number of vehicles with different power types compared to the same period last year

In 2025, the output value and number of traditional automobiles will both decline by 7% year-on-year, while new energy vehicles will still show strong growth momentum. Among them, the output value and number of plug-in hybrid and extended range electric vehicles will have outstanding year-on-year increases, both exceeding 30%.

6、Cumulative number of new energy brands entering the factory year-on-year

In 2025, the after-sales market for new energy vehicles will experience a comprehensive outbreak, and the number of core brands entering the factory will all be red: Tank leads the industry with a year-on-year growth rate of 83%, followed closely by Xiaopeng with a growth rate of 55%, AITO、 Brands such as Geely, Jike, and GAC Aion have also achieved a year-on-year growth of over 40%, demonstrating strong after-sales demand.

7、Industry Trends in the Fourth Quarter of 2025

In the fourth quarter of 2025, the sales volume of passenger cars cooled down, but it still increased by 4% year-on-year for the whole year.

1、The sales of passenger cars in the fourth quarter have cooled down

In terms of narrow passenger cars, retail sales in October 2025 decreased by 0.5% year-on-year, 8.1% year-on-year in November, and 13% year-on-year in December, with a continuous decline in growth rate for three months. The intensification of various policies at the end of last year stimulated the demand for exchange purchases, and the market was booming. At the end of this year, policies have been tightened, and the market has gradually returned to rigid purchasing demand, with the growth rate declining in line with expectations. But the cumulative sales for the whole year were 23.779 million vehicles, still up 4% year-on-year, mainly due to the accumulation of policy dividends in the first three quarters.

2、Car companies offer discounts on purchase tax to stabilize demand for car purchases

Starting from January 1, 2026, the purchase tax for new energy vehicles will be adjusted from full exemption to a 50% reduction, with a maximum exemption limit of 15000 yuan per vehicle. In response to policy adjustments, several mainstream car companies such as GAC, SAIC, and Xiaopeng have launched purchase tax "backstop" or equal subsidy schemes to offset cost changes caused by policy retreat by offering discounts.

3、The trade in policy will continue in 2026

According to data from the Ministry of Commerce, the "trade in" policy for automobiles in 2025 has had a significant effect, driving sales of over 11.5 million vehicles, accounting for more than one-third of the overall automobile sales and becoming the core driving force supporting annual growth. At the National Financial Work Conference in December, Minister of Finance Lan Fo'an stated that in 2026, the government will vigorously boost consumption, implement special actions to boost consumption, continue to allocate funds to support the exchange of old for new consumer goods, and adjust and optimize the scope and standards of subsidies.

4、Activate emerging consumption in the automotive aftermarket

On November 25, 2025, the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Commerce, the Ministry of Culture and Tourism, the People's Bank of China, and the State Administration for Market Regulation issued a notice on the implementation plan to enhance the adaptability of consumer goods supply and demand and further promote consumption. Propose to expand the consumption of automotive aftermarket such as car modification, RV camping, and car racing, which is expected to activate emerging fields such as modification and promote the transformation of the aftermarket from "car repair business" to "life economy".

For more real-time market data, please follow the F6 Big Data Research Institute mini program