▍From the proportion of basic maintenance visits in the market in the past two years, it can be seen that due to the influence of the Spring Festival holiday, the demand for basic maintenance is at its peak in the first quarter of each year, and the number of visits to the factory has significantly increased. In the first quarter of 2023, the proportion of basic maintenance visits to the factory exceeded 35%, reaching a peak in nearly two years.

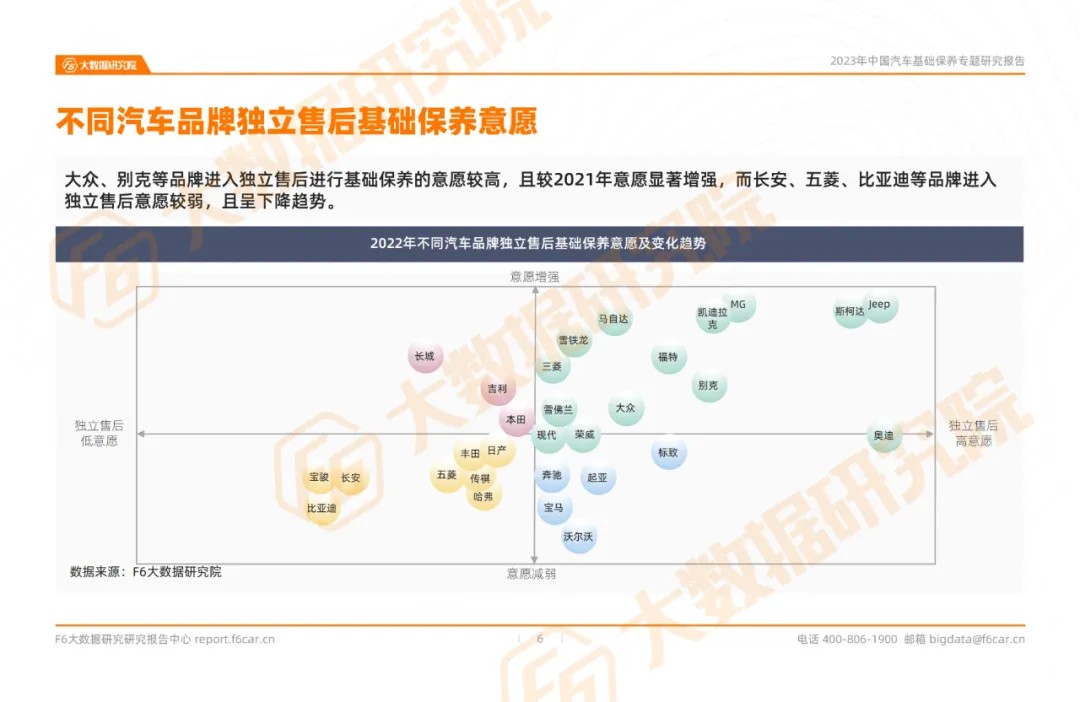

▍Brands such as Volkswagen and Buick have a higher willingness to enter independent after-sales service for basic maintenance, and their willingness has significantly increased compared to 2021. However, brands such as Changan, Wuling, and BYD have a weaker willingness to enter independent after-sales service and are showing a downward trend.

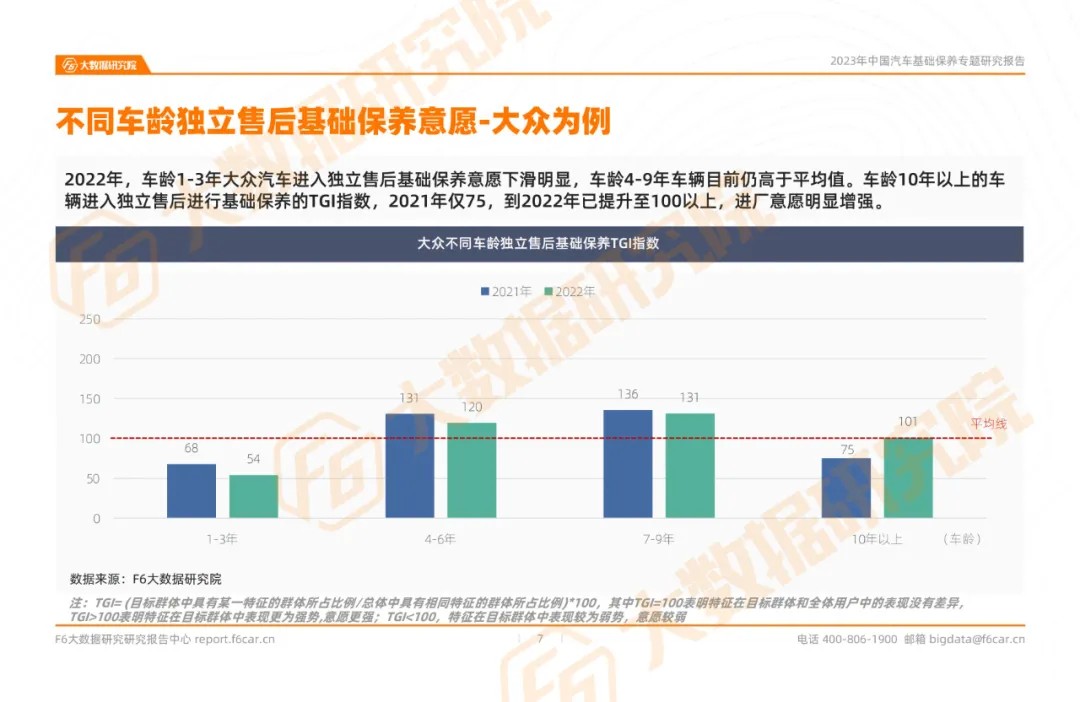

▍In 2022, Volkswagen's willingness to enter independent after-sales basic maintenance for vehicles aged 1-3 years has significantly declined, and vehicles aged 4-9 years are still above average. The willingness of vehicles over 10 years old to undergo basic maintenance through independent after-sales service has significantly increased.

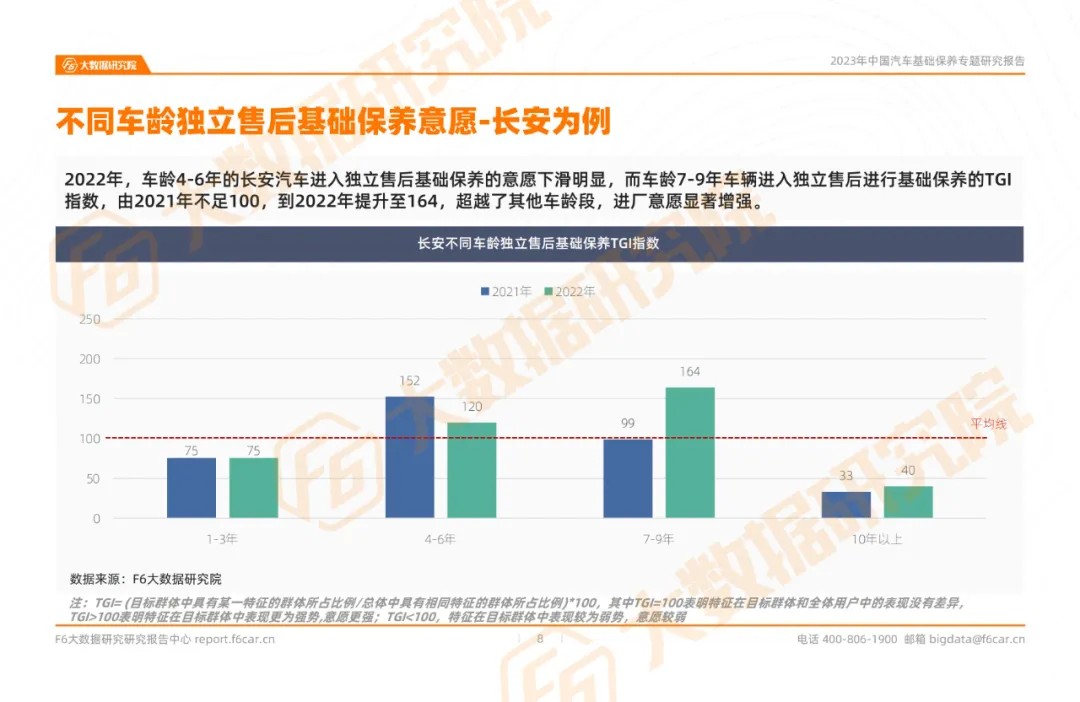

▍In 2022, the willingness of Changan Automobile with 4-6 years of age to enter independent after-sales basic maintenance has significantly declined, while the TGI index of vehicles with 7-9 years of age entering independent after-sales basic maintenance has surpassed other age groups, indicating a significant increase in the willingness to enter the factory.

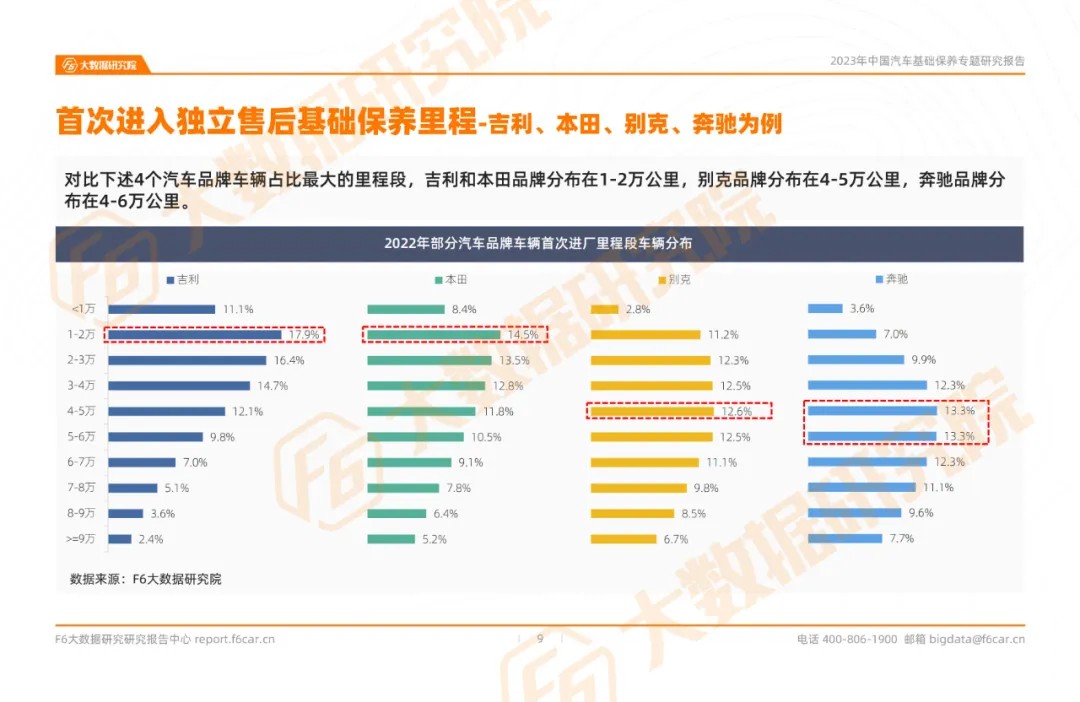

▍Comparing the mileage ranges with the highest proportion of vehicles from the following four car brands, Geely and Honda brands are distributed between 10000-20000 kilometers, Buick brand is distributed between 40000-50000 kilometers, and Mercedes Benz brand is distributed between 40000-60000 kilometers.

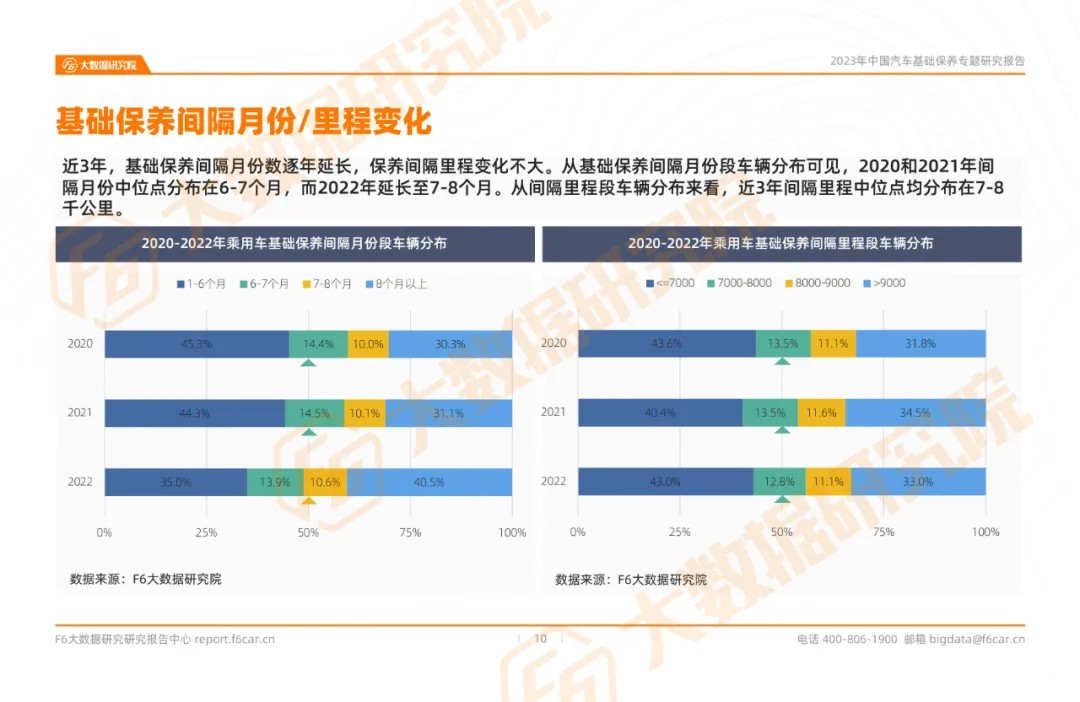

▍In the past three years, the number of basic maintenance intervals has been increasing year by year, and the maintenance interval mileage has not changed much.

From the distribution of vehicles in the basic maintenance interval months, it can be seen that the median distribution of interval months in 2020 and 2021 is 6-7 months, while in 2022 it has been extended to 7-8 months.

From the distribution of vehicles in the interval mileage range, the median interval mileage in the past 3 years has been distributed between 7-8 thousand kilometers.

▍Among the top 20 car brands in terms of ownership, Mazda has the longest average maintenance interval for basic maintenance, while Wuling has the shortest maintenance interval.

▍Among the 10 vehicle brands with a basic maintenance cycle of 10000 kilometers, over 50% of Volvo, BMW, and Mercedes Benz vehicles undergo regular maintenance according to the maintenance manual, while over 40% of Volkswagen, Ford, and other car brands undergo early maintenance.

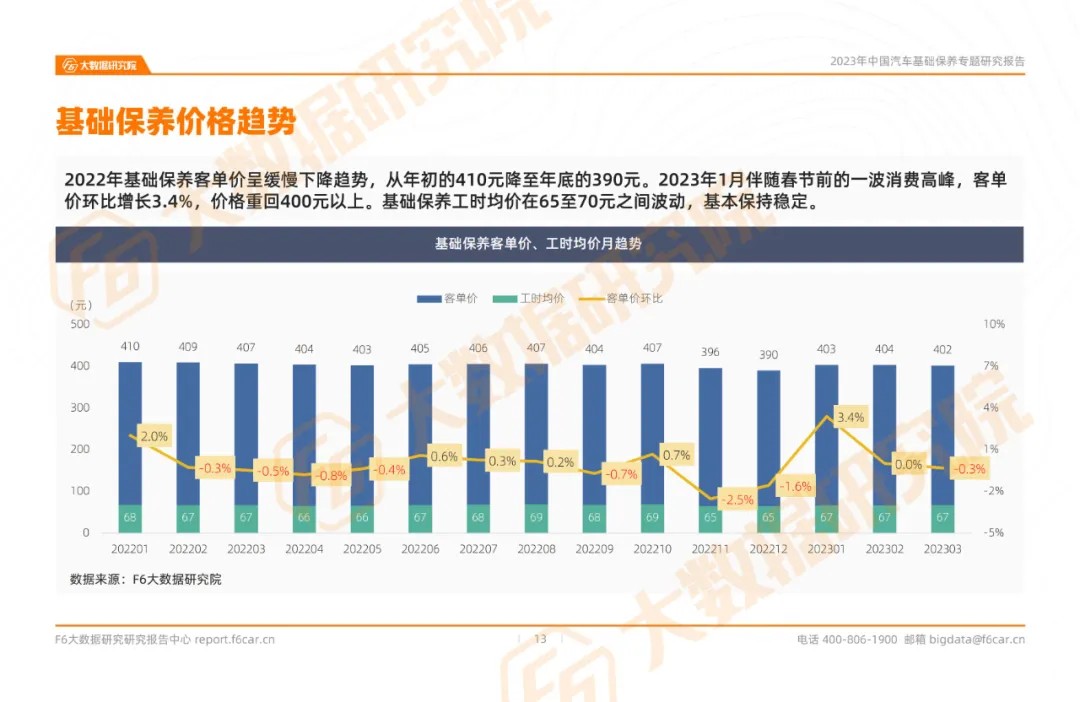

▍The unit price of basic maintenance in 2022 is showing a slow downward trend, dropping from 410 yuan at the beginning of the year to 390 yuan at the end of the year. In January 2023, with a wave of consumption peak before the Spring Festival, the average unit price increased by 3.4% month on month, and the price returned to over 400 yuan. The average cost of basic maintenance hours fluctuates between 65 and 70 yuan, but remains relatively stable.

▍According to the ranking of basic maintenance unit prices for car brands in 2022, Porsche ranks first with a unit price of 929 yuan, followed by Land Rover and Mercedes Benz in third place. In the TOP20 ranking, German and American cars each occupy 5 seats, while Japanese and domestic brands each occupy 4 seats. Lynk&Co ranks seventh with a unit price of 616 yuan and is the only domestic brand to enter the TOP10.

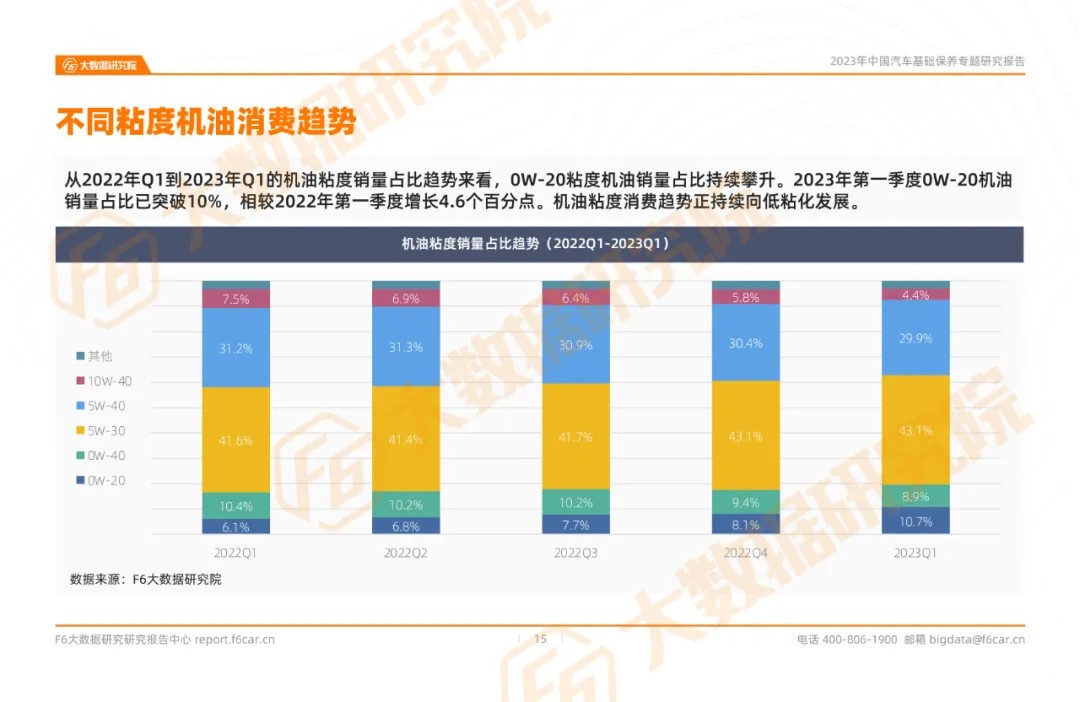

▍From Q1 2022 to Q1 2023, the sales proportion of 0W-20 viscosity engine oil continues to rise. The proportion of 0W-20 engine oil sales in the first quarter of 2023 has exceeded 10%, an increase of 4.6 percentage points compared to the first quarter of 2022. The consumption of engine oil is continuing to develop towards a trend of low viscosity.

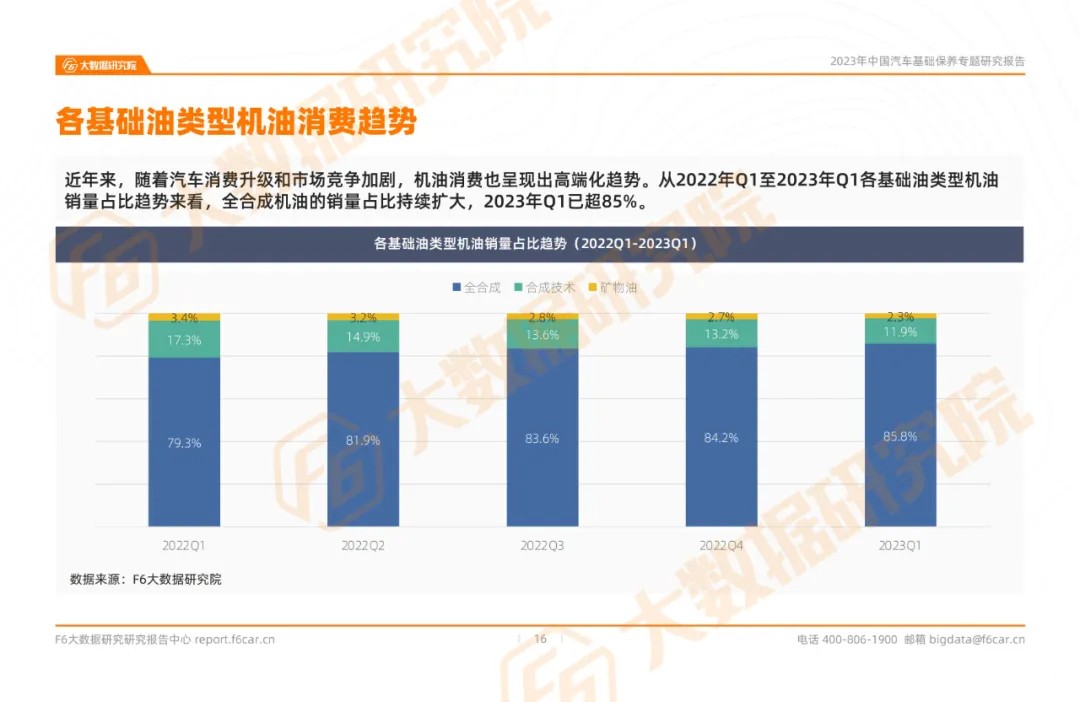

▍In recent years, with the upgrading of automobile consumption and intensified market competition, oil consumption has also shown a trend towards high-end. From Q1 2022 to Q1 2023, the sales proportion of various base oil types of engine oil shows a continuous expansion, with the sales proportion of fully synthetic engine oil exceeding 85% in Q1 2023.